American sanctions against Rosneft and Lukoil are in effect, but have been temporarily relaxed/waived regarding the operation of gas stations including in Romania and other countries until April 2026, provided that revenues do not go to Russia. Romania is working on a legal framework for the takeover/management of assets in Romania affected by sanctions, but the deadline for finding a buyer/reorganization is short even though it has been extended until January 2026.

The sanctions imposed by the United States against Russian oil companies Rosneft and Lukoil open a new chapter in an already fragile energy region. For many countries in Central and Southeast Europe, the targeted companies are not just simple names in the global market, but essential suppliers, owners of refineries, investors in infrastructure, and even pillars of fuel price balance for gasoline and diesel.

Therefore, the effect of the sanctions is not uniform. It depends on three fundamental elements:

- Dependence on oil and derivative products from the sanctioned companies;

- Local contracts and investments where Lukoil and Rosneft have a direct role;

- Connections to refineries, storage, and infrastructure linked to Russian flows.

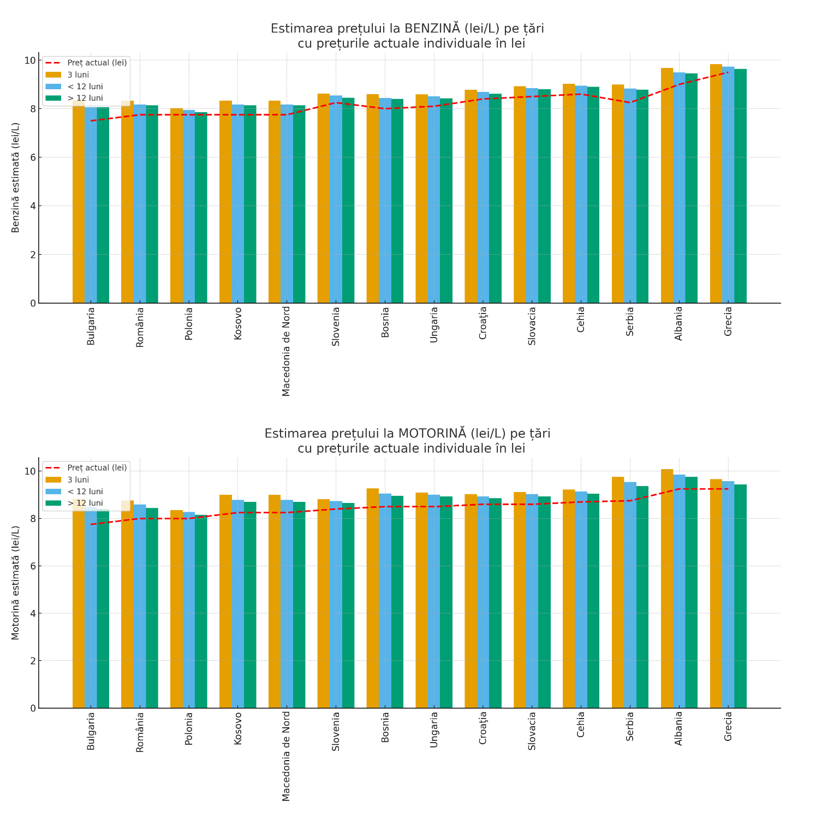

The result is a divided energy map, where some countries face significant price pressures, others have solid alternatives, and a few feel the effects only through the regional market. The analysis is conducted under the conditions of maintaining prices for gasoline and the euro-dollar exchange rate throughout this period.

The most exposed region where every percentage counts is:

Bulgaria – the epicenter of vulnerability

Bulgaria is at the center of the storm. The Lukoil Neftochim Burgas refinery, the largest in the Balkans, dominates the domestic market and partially supplies the region. Any disruption in its supply is immediately transmitted to consumers.

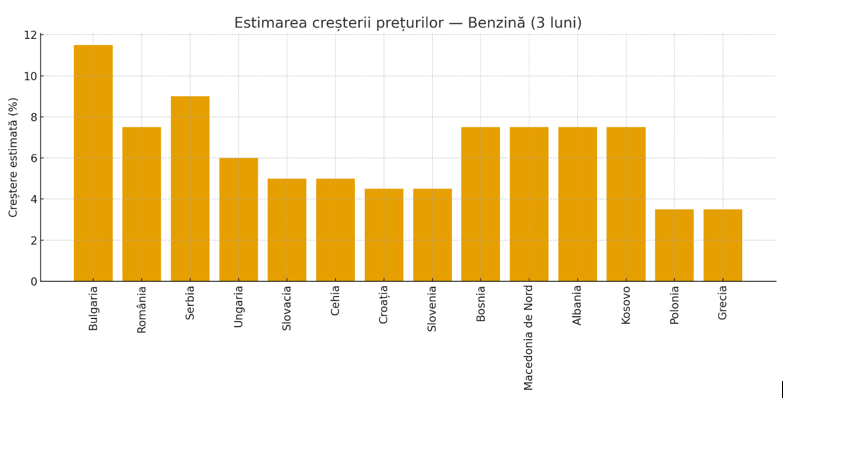

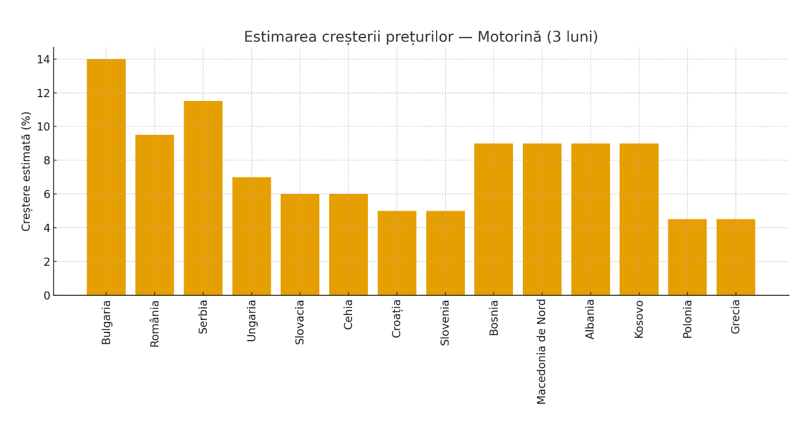

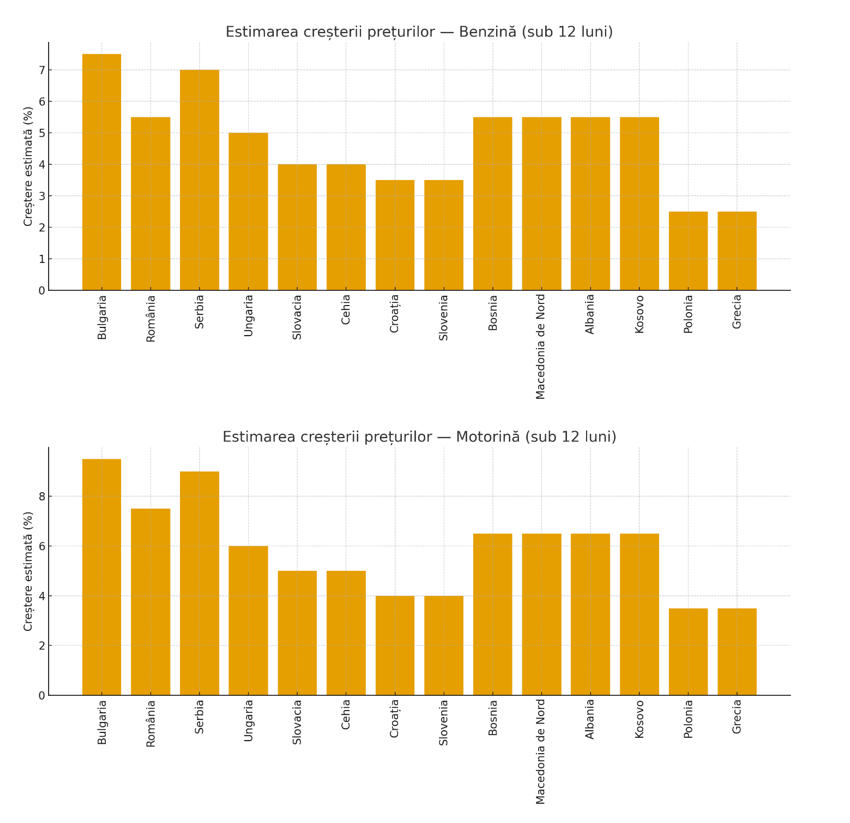

Estimates show that in the first three months, the price of gasoline could increase by 8–15%, and diesel by 10–18%, with a slow normalization only after a year.

Romania – between structural vulnerability and adaptability

Romania has an intermediate position: the Lukoil Petrotel refinery in Ploiești is an important link, but the Romanian market also has alternative capacities, such as Petrom and Rompetrol.

Estimated increases are more moderate: 5–10% for gasoline in the first three months and 7–12% for diesel. However, pressure is quickly transmitted through the regional market, where Russian flows still play a significant role.

Serbia – a prisoner of regional connectivity

Serbia is heavily dependent on energy routes in the region and on flows from companies now under sanctions. The estimated impact is comparable to the situation in Romania, but with less flexibility in quickly finding alternatives.

Countries with medium exposure that have played a balanced game

In Central Europe, Hungary, Slovakia, and the Czech Republic historically linked to refineries powered by Russian oil, have gradually been pushed by EU policies in recent years to diversify their sources.

- Hungary: estimated spending of 4–8% on gasoline and 5–9% on diesel in the first months, but with a noticeable long-term mitigation.

- Slovakia and Czech Republic: similar effects, mitigated by access to European pipelines and maritime terminals in Germany and Poland.

For these states, the applied sanctions pose a serious challenge, but not a structural crisis.

Indirect effects will also exist in other countries in the area where the regional market dictates price movements

Countries such as Croatia, Slovenia, Bosnia and Herzegovina, North Macedonia, Albania, and Kosovo do not directly depend on refineries operated by the sanctioned companies, but are sensitive to fluctuations in the neighborhood.

When Bulgaria or Romania faces rapid price increases, the pressure is immediately felt in the regional supply chain. Here, price increases in the first quarter can range between 3–10% for gasoline and 3–12% for diesel, depending on each country's position on trade routes.

Well-diversified countries: hit only by the external wave

Poland and Greece are the positive examples of the region. Both have robust access to maritime markets, modern terminals, and multiple supply sources.

Here, the effects are moderate – between 2–5% in the first months, with a tendency for rapid stabilization.

The sanctions imposed on Rosneft and Lukoil are more than a geopolitical measure: they are a stress test for the energy network of Central and Southeast Europe.

The region discovers once again that energy markets are interdependent: a dominant refinery in Bulgaria can influence prices in Bosnia; a decision in Washington can raise pump prices in Belgrade; and accelerated diversification in Poland can become a model for Southeast countries.

In the next 12 months, we are likely to see a mix of price adjustments, forced investments in alternatives, but also an acceleration of European energy integration – an inevitable step as caring for energy security becomes as important as military security.

In this context, the increase in royalties for gas fields in Romania will force the closure of many operations, as production will no longer be profitable. Romania will end up importing even more gas, deepening external dependence and undermining the country's energy security.

.webp)