.webp)

Launch of the Energy Security Barometer, fifth edition, October 28, 2025

According to the latest Energy Security Barometer conducted by INSCOP Research, during the period of September 29 - October 7, 2025, commissioned by the Strategic Thinking Group, if they had enough money, 30.9% of Romanians would choose to purchase a hybrid car, 19.9% a diesel one, 18.6% electric, 18.1% gasoline, 6.3% LPG, and 3.7% do not know. 2.5% represents the percentage of non-responses.

Voters of USR, high-income individuals, and respondents with higher education choose to purchase a hybrid car in a higher proportion than the rest of the population. They would purchase a diesel car mainly: primary school graduates and respondents with very low incomes. They would choose to purchase an electric car especially: PNL voters and individuals aged between 30 and 45 years. AUR voters, individuals aged between 45 and 60 years, and respondents with very low incomes choose to purchase a gasoline car in a higher proportion than the rest of the population.

Methodology:

− The national opinion poll was conducted by INSCOP Research on behalf of the Strategic Thinking Group

− Data was collected during the period of September 29 - October 7, 2025.

− Research method: interview via questionnaire.

− Data was collected using the CATI method (telephone interviews), with a simple random sample volume of 1100 individuals, representative of significant socio-demographic categories (gender, age, occupation) for the non-institutionalized population of Romania, aged 18 and over.

− The maximum allowable error of the data is ± 2.95%, at a confidence level of 95%.

Energy Security Barometer, now in its fifth edition, will be launched at an event organized on October 28, at the Bucharest Academy of Economic Studies, starting at 10 AM, as part of the NewMoneyTalks conference series. The event is organized with the support of the Bucharest Academy of Economic Studies, Romgaz, OMV Petrom, PPC Renewables, and Rezolv Energy.

The presentation of the sociological research will be followed by a debate involving representatives of the competent public authorities, companies, the academic environment, experts, and media representatives.

The most important topics addressed in the Energy Security Barometer:

1. The impact of the war in Ukraine on the energy crisis – perceptions regarding the link between the conflict and energy price increases.

2. Exploitation of gas in the Black Sea (Neptun Deep) – economic benefits, energy independence

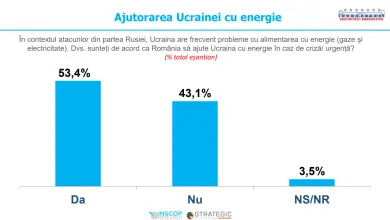

3. Regional relations and energy solidarity – support for Moldova and Ukraine, as well as mutual aid mechanisms within the EU.

4. Energy sources and energy independence – public opinion on renewable, nuclear, natural gas, and other sources of energy.

5. Energy and fuel prices – perceived causes of price increases and the responsibility of the state, companies, or international factors.

6. Government policies and regulation – price caps, subsidies, consumer assistance, and options regarding regulated vs. free market.

7. Vulnerable consumers and social support – defining energy vulnerability and preference between direct assistance or measures for energy efficiency.

8. The role of the state vs. private companies in the energy sector

9. Changing energy suppliers – consumers' openness to alternative offers for natural gas and electricity.

The graphical presentation of the data is available here: Energy Security Barometer, fifth edition

.webp)